Written By:

Evan Watts

Director

ewatts@bys-hfc.com

Under normal circumstances healthcare providers operate in an ever-changing, dynamic environment. Relief provided to healthcare providers in response to the pandemic compounds this reality. Despite many unknowns in the midst of the pandemic, here are some key dates for 2021:

Now through 12/31/21: Suspension of 2% Medicare Sequestration. The CARES Act initially suspended the 2% Medicare sequestration for 05/01/20 through 12/31/20. This sequestration suspension was extended until 03/31/21 due to the Consolidated Appropriations Act of 2021 passed in late Dec20. On 04/13/21, Congress passed a bill further suspending the sequestration through 12/31/21.

Lenders should consider how the suspension of 2% Medicare Sequestration impacts borrowers’ budgets/projections for 2021 and 2022 and consequently covenants.

Through 05/31/21: PPP is open for eligible companies (Available PPP funds were depleted on 05/05/21). On December 27, 2020, the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act (“Economic Aid Act”) became law and authorized new and additional PPP loans.

New PPP Loans: Companies without 2020 PPP loans may apply for their First-Draw PPP loan.

Additional PPP Loans: Companies with 2020 PPP loans may apply for their Second-Draw PPP loan. The Second-Draw PPP loan requirements are as follows: a) company has 300 or fewer employees; b) the company utilized the full amount of their first PPP loan to pay eligible expenses; c) the company experienced a reduction of 25% or more in gross receipts for any 2020 quarter as compared to the same quarter for 2019; and d) the company has not permanently closed. The formula for Second-Draw PPP loans is similar to that of initial loans but the maximum Second-Draw PPP loan is $2 million rather than $10 million. The SBA began accepting PPP applications in mid-Jan21 with an initial deadline of March 31, 2021, which was extended until May 31, 2021, until available PPP funds ran out on May 5, 2021.

Lenders should request their borrowers keep them informed of 2021 PPP loan applications as well as follow-up on the status of 2020 PPP loan forgiveness applications.

03/30/21: Medicare AAPP Repayment Begins. In order to increase cash flow to providers of services and suppliers impacted by the pandemic, CMS expanded the Medicare Accelerated/Advance Payment Program. The expansion of this program provided A/R funds in advance to accelerate cash flow to providers fighting the pandemic. On April 26th, 2020, CMS announced this program would be suspended, but providers were able to apply for these advanced A/R funds until October 2020.

Recoupment begins one year from the initial payment receipt, which was late March and April for many providers. Recoupments equal to 25% of Medicare remittance advices will occur for the first 11 months of repayment.

Lenders should prepare for reduced Medicare collections by establishing an adequate reserve. As the recoupments will be 25% of Medicare collections for the first 11 months of the recoupment window, BY&S typically recommends a reserve equal to 25% of Net Eligible Medicare A/R or 25% of average trailing 3-month Medicare collections. Additionally, lenders should consider monitoring AAPP recoupments to date as provider’s repayment plans will vary across their portfolio.

BY&S has noted that recoupments began at the beginning of Apr21 and has reviewed several recoupments via Medicare remittance advices. These recoupments are identified on the remittance advices with PBL code “WO” and the reference code beginning with “CVDAR” followed by the reference number. BY&S offers real time monitoring of Medicare AAPP recoupments for our clients, if desired.

07/31/21: 2020 Medicare Cost Reports Due. CMS extended the due date requirement for 2020 Medicare Cost Reports by 2 months. For providers that use a fiscal year end of 12/31, the initial due date of 05/31/21 is extended to 07/31/21.

Lenders should inquire with their borrowers when they plan to file and whether the filings include liabilities to be paid back to Medicare.

12/31/21: 50% of Deferred Payroll Tax Payments Due. The CARES Act included the option for nearly all employers to take part in the Deferral of Employer Social Security Taxes (6.2% of wages) for the period 03/27/20 through 12/31/20. 50% of the amount deferred is payable at 12/31/21 with the remaining 50% due 12/31/22. The PPP Flexibility Act clarified that PPP loan recipients (even those that receive loan forgiveness) may utilize this tax deferral.

Lenders should prepare to be adequately reserved when the first 50% payment to the IRS is due at the end of the year. For example, a reserve that equals 1/24th of the total deferred payroll taxes multiplied by the number of months since 12/31/20 would establish a 50% reserve by 12/31/21.

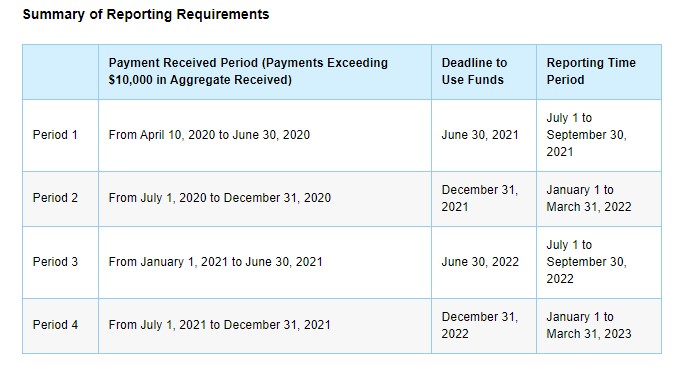

TBD: Provider Relief Fund (“PRF”) Reporting Requirements. As the Department of Health and Human Services (“HHS”) disbursed needed PRFs, providers needed to accept Terms and Conditions. In 2021, all providers that received $10,000 or more must complete post-payment reporting requirements while providers that spent $750,000 or more are subject to Single Audit requirements. The 2020 Single Audit reporting package requires providers to report on lost revenue, COVID-19 expenses, basic organization information, other assistance received in 2020 and non-financial information. HHS indicates that any recipient identified as having provided inaccurate information to HHS will be subject to payment recoupment and other legal action.

HHS recently revised the PRF reporting requirements and timeframes for reporting on the use of the funds. See the table below for the deadlines for using the PRF funds and reporting on the use of those funds. Read more about the recent HHS news release here.

Lenders should keep tabs on borrowers’ compliance with the recently released reporting timeframes and updated reporting requirements.