The BY&S monitoring team is prepared to review and report on the Medicare Accelerated/Advance Payment Program (“MAAPP”) recoupment progress for borrowers in a lender’s portfolio. We offer near real-time updates of amounts recouped through the review of Medicare remittance advices and provide an update on the MAAPP amounts outstanding on a facility by facility as well as portfolio wide basis. This can help lenders ensure that MAAPP amounts are on track to be repaid within the 17-month period or allow our lenders to be prepared for a lump sum payment at the end of the recoupment window. Accurately monitoring the MAAPP amounts due will allow lenders to properly reserve for MAAPP amounts and manage risk throughout the recoupment process.

As we mentioned in our article, ‘Important Dates to Know for 2021’, CMS expanded the MAAPP on March 28th, 2020. This expansion allowed providers to receive as much as three months of average Medicare receipts in advance, creating accelerated cash flow to help in their fight against the pandemic. CMS initially suspended applications for the program on April 26th 2020, though they later reversed that decision and accepted applications until October 8th, 2020.

Recoupment for the MAAPP begins one year from the initial payment receipt. The date recoupment begins for borrowers depends on the date they received the funds. This could have been as recent as late March 2021, though the exact start date depends on the provider’s Medicare payment cycle. Many providers applied for MAAPP in April of 2020, resulting in a recoupment start date of April 2021.

Recoupments equal to 25% of Medicare remittance advices will occur for the first 11 months of repayment and 50% for the next 12 through 17 months. As these amounts represent a direct offset to Medicare A/R collateral, it is critical for lenders to know the balance of their borrower’s MAAPP liability. Tracking the MAAPP liability with timely recoupment information gives the lender the ability to monitor and adjust any reserves on their borrower’s BBC to prevent an over-advance situation. BY&S has the experience and expertise to help lenders actively track their borrower’s MAAPP liabilities.

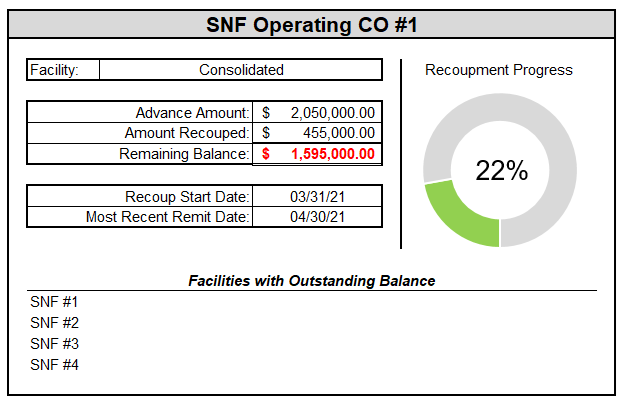

A sample of a Summary MAAPP Recoupment Dashboard is provided below:

For more information about our MAAPP monitoring services, contact Jake Schlicht at jschlicht@bys-hfc.com.